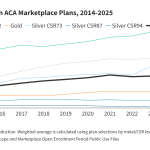

This analysis documents average deductibles for Affordable Care Act Marketplace plans available on Healthcare.gov in 2025 for all metal tiers, including silver plans after cost-sharing reductions are applied, as well as trend data since 2014.

Deductibles in ACA Marketplace Plans, 2014-2025

Related Post

Explaining Individual Coverage Health Reimbursement Arrangements (ICHRAs)

This policy explainer describes what Individual Coverage Health Reimbursement Arrangements (ICHRAs) are and how do they differ from typical employer-sponsored ...

Average Annual Deductible per Enrolled Employee in Employer-Based Health Insurance for Single and Family Coverage

...

Health Provisions in the 2025 Federal Budget Reconciliation Law

On July 4, President Trump signed the budget reconciliation bill, previously known as the “One Big Beautiful Bill Act,” into ...

How Might Expiring Premium Tax Credits Impact People with HIV?

This issue brief provides an overview of the potential impact not extending enhanced ACA premium tax credits could have on ...

Explaining Health Care Reform: Questions About Health Insurance Subsidies

This brief provides an overview of the financial assistance provided under the ACA for people purchasing coverage on their own ...

The Regulation of Private Health Insurance

This Health Policy 101 chapter explores the complex landscape of private health insurance regulation in the United States, detailing the ...

Calculator: ACA Enhanced Premium Tax Credit

The ACA’s enhanced premium tax credits are set to expire at the end of 2025. This calculator estimates how much ...

Policy Changes Bring Renewed Focus on High-Deductible Health Plans

Policy changes, anticipated increases in premium costs for enrollees, and new standards for health savings accounts may encourage consumers to ...

Premiums and Worker Contributions Among Workers Covered by Employer-Sponsored Coverage, 1999-2025

Since 1999, the Employer Health Benefits Survey has documented trends in employer-sponsored health insurance. Every year, private and non-federal public ...