This searchable timeline shows the implementation date for the health care provisions included in the 2025 federal budget reconciliation law. previously known as “One Big Beautiful Bill Act.” It includes provisions related to Medicaid, the Affordable Care Act, Medicare and Health Savings Accounts (HSAs).

Implementation Dates for 2025 Budget Reconciliation Law

Related Post

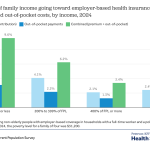

How Affordability of Employer Coverage Varies by Family Income

This analysis looks at the share of family income people with employer-based coverage pay toward their premiums and out-of-pocket payments ...

A Backlash Against Health Insurers, Redux

In this JAMA Health Forum post, Executive Vice President Larry Levitt recalls the mid-1990s’ public backlash against Health Maintenance Organizations ...

Average Annual Employee-Plus-One Premium per Enrolled Employee For Employer-Based Health Insurance

...

New Rule Proposes Changes to ACA Coverage of Gender-Affirming Care, Potentially Increasing Costs for Consumers

This brief examines a proposed rule that seeks to change how ACA plans would cover gender affirming care services. If ...

Calculator: ACA Enhanced Premium Tax Credit

The ACA’s enhanced premium tax credits are set to expire at the end of 2025. This calculator estimates how much ...

The Performance of the Federal Independent Dispute Resolution Process through Mid-2024

The No Surprises Act, which was signed into law by President Trump during his first term and took effect in ...

ACA Preventive Services Are Back at the Supreme Court: Kennedy v. Braidwood

This brief provides an overview of the most recent ACA case under review at the Supreme Court (Kennedy v. Braidwood ...

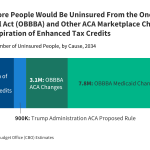

How Will the One Big Beautiful Bill Act Affect the ACA, Medicaid, and the Uninsured Rate?

This analysis details the number of people who would become uninsured from policy changes in the ACA Marketplaces and Medicaid. ...

The Semi-Sad Prospects for Controlling Employer Health Care Costs

In a commentary on KFF’s 27th employer health benefits survey, President and CEO Dr. Drew Altman discusses the obstacles employers ...