This issue brief provides an overview of the potential impact not extending enhanced ACA premium tax credits could have on people with HIV and the Ryan White HIV/AIDS Program. Enhanced credits have improved insurance coverage affordability for millions of people, including those with HIV. People with HIV may be particularly vulnerable, given that they are more likely to have Marketplace plans and many also rely on the federally-funded Ryan White HIV/AIDS Program to help cover plan costs. Loss of coverage and increased costs could lead to disruptions in care for people with HIV which could have serious implications for individual and public health.

How Might Expiring Premium Tax Credits Impact People with HIV?

Related Post

Distribution of People Ages 0-64 with Employer Coverage by Race/Ethnicity

disparity, Disparities ...

Policy Changes Bring Renewed Focus on High-Deductible Health Plans

Policy changes, anticipated increases in premium costs for enrollees, and new standards for health savings accounts may encourage consumers to ...

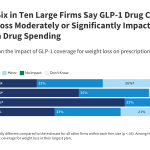

Perspectives from Employers on the Costs and Issues Associated with Covering GLP-1 Agonists for Weight Loss

While more large employers are covering GLP-1 drugs for weight loss, KFF’s conversations with employers highlight concerns about the cost ...

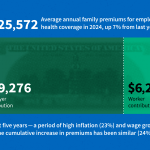

Annual Family Premiums for Employer Coverage Rise 7% to Average $25,572 in 2024, Benchmark Survey Finds, After Also Rising 7% Last Year

Family premiums for employer-sponsored health insurance rose 7% this year to reach an average of $25,572 annually, KFF’s 2024 benchmark ...

2024 Employer Health Benefits Survey

This annual survey of employers provides a detailed look at trends in employer-sponsored health coverage, including premiums, worker contributions, cost-sharing ...

Health Provisions in the 2025 Federal Budget Reconciliation Law

On July 4, President Trump signed the budget reconciliation bill, previously known as the “One Big Beautiful Bill Act,” into ...

2024 Employer Health Benefits Chart Pack

This slideshow captures key data from the 2024 KFF Employer Health Benefits Survey survey, providing a detailed look at trends ...

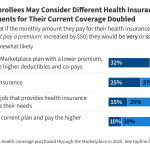

2025 KFF Marketplace Enrollees Survey

This survey explores how ACA Marketplace enrollees expect to respond if their premium payments doubled as expected in 2026 when ...

The Regulation of Private Health Insurance

This Health Policy 101 chapter explores the complex landscape of private health insurance regulation in the United States, detailing the ...

Distribution of People Ages 0-64 with Employer Coverage by Federal Poverty Level (FPL)

...