As Marketplace Open Enrollment nears, policy changes could leave millions of people facing substantially higher premiums and coverage loss, which could lead more consumers to purchase less expensive and less comprehensive coverage through short-term health plans. KFF analyzes short-term health policies sold by nine large insurers in 36 states, examining premiums, cost sharing, covered benefits, and coverage limitations and comparing them to ACA Marketplace plans.

Examining Short-Term Limited-Duration Health Plans on the Eve of ACA Marketplace Open Enrollment

Related Post

Deductibles in ACA Marketplace Plans, 2014-2026

This analysis documents average deductibles for Affordable Care Act Marketplace plans available on Healthcare.gov in 2026 for all metal tiers, ...

How ACA Marketplace Costs Compare to Employer-Sponsored Health Insurance

This analysis compares ACA Marketplace costs to employer-sponsored health insurance costs and finds that individual market premiums have become more ...

Health Policy in 2026

In a new column, President and CEO Dr. Drew Altman forecasts eight things to look for in health policy in ...

Health Insurance Marketplace Calculator

The Health Insurance Marketplace Calculator, updated with 2025 premium data, provides estimates of health insurance premiums and subsidies for people ...

Expansions to Health Savings Accounts in House Budget Reconciliation: Unpacking the Provisions and Costs to Taxpayers

The House budget reconciliation bill contains various expansions to Health Savings Accounts (HSAs). This policy watch explains what HSAs are, ...

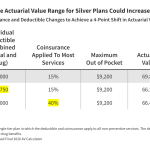

Pending Changes to Marketplace Plans Could Increase Cost Sharing for Consumers

This brief looks at changes to Marketplace plans recently finalized by the Centers for Medicare and Medicaid Services (CMS) that ...

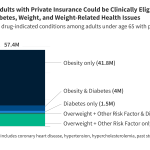

How Many Adults with Private Health Insurance Could Use GLP-1 Drugs

More than two in five (42%) or 57.4 million adults under 65 with private insurance could be eligible under clinical ...

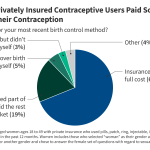

Policy Landscape of Private Insurance Coverage of Contraception in the U.S.

This issue brief explains the rules for private insurance coverage of contraceptives at the federal and state level, the exemptions ...

Premiums and Worker Contributions Among Workers Covered by Employer-Sponsored Coverage, 1999-2025

Since 1999, the Employer Health Benefits Survey has documented trends in employer-sponsored health insurance. Every year, private and non-federal public ...

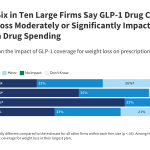

Perspectives from Employers on the Costs and Issues Associated with Covering GLP-1 Agonists for Weight Loss

While more large employers are covering GLP-1 drugs for weight loss, KFF’s conversations with employers highlight concerns about the cost ...