The ACA’s enhanced premium tax credits are set to expire at the end of 2025. This calculator estimates how much out-of-pocket premiums would increase for families if Congress does not extend the credits. The projected premium increases are estimated based on family income, zip code, size, ages, and 2025 ACA Marketplace premiums.

Calculator: ACA Enhanced Premium Tax Credit

Related Post

Average Annual Employee-Plus-One Premium per Enrolled Employee For Employer-Based Health Insurance

...

Access to OB-GYNs: Evaluating Workforce Supply and ACA Marketplace Networks

This brief examines the supply of OB-GYNs in the U.S. and the share of OB-GYNs participating in the provider networks ...

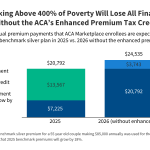

Premium Payments if Enhanced Premium Tax Credits Expire

This data note examines how the expiration of the ACA’s enhanced premium tax credits could affect the out-of-pocket portion of ...

How ACA Marketplace Costs Compare to Employer-Sponsored Health Insurance

This analysis compares ACA Marketplace costs to employer-sponsored health insurance costs and finds that individual market premiums have become more ...

Premiums and Worker Contributions Among Workers Covered by Employer-Sponsored Coverage, 1999-2025

Since 1999, the Employer Health Benefits Survey has documented trends in employer-sponsored health insurance. Every year, private and non-federal public ...

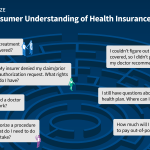

Navigating the Maze: A Look at Health Insurance Complexities and Consumer Protections

This brief discusses how consumers understand what their insurance covers, what to do when coverage for care is denied, and ...

Employer Health Benefits Annual Survey Archives

KFF has conducted this annual survey since 1999. ...

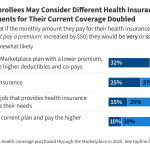

2025 KFF Marketplace Enrollees Survey

This survey explores how ACA Marketplace enrollees expect to respond if their premium payments doubled as expected in 2026 when ...

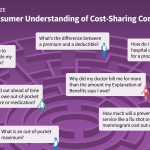

Navigating the Maze: A Look at Patient Cost-Sharing Complexities and Consumer Protections

This brief focuses on consumers’ understanding of health insurance costs and examines existing federal protections that seek to address barriers ...