Lloyd’s, the insurance and reinsurance marketplace, has made a strategic investment in BreachBits, a cyber risk innovation company founded by former US military cyber warfare veterans.

This marks Lloyd’s third investment in cutting-edge solutions from alumni of its Lloyd’s Lab, following BreachBits’ successful participation in the accelerator program’s 13th cohort, which ran from September to December 2024.

This marks Lloyd’s third investment in cutting-edge solutions from alumni of its Lloyd’s Lab, following BreachBits’ successful participation in the accelerator program’s 13th cohort, which ran from September to December 2024.

BreachBits is redefining the cyber insurance landscape with two groundbreaking products developed specifically for the Lloyd’s market: the Cyber Questionnaire Validator and Cyber Pre-Claim Intervention.

These tools are designed to streamline the underwriting process, improve risk selection, and enhance profitability for carriers and brokers.

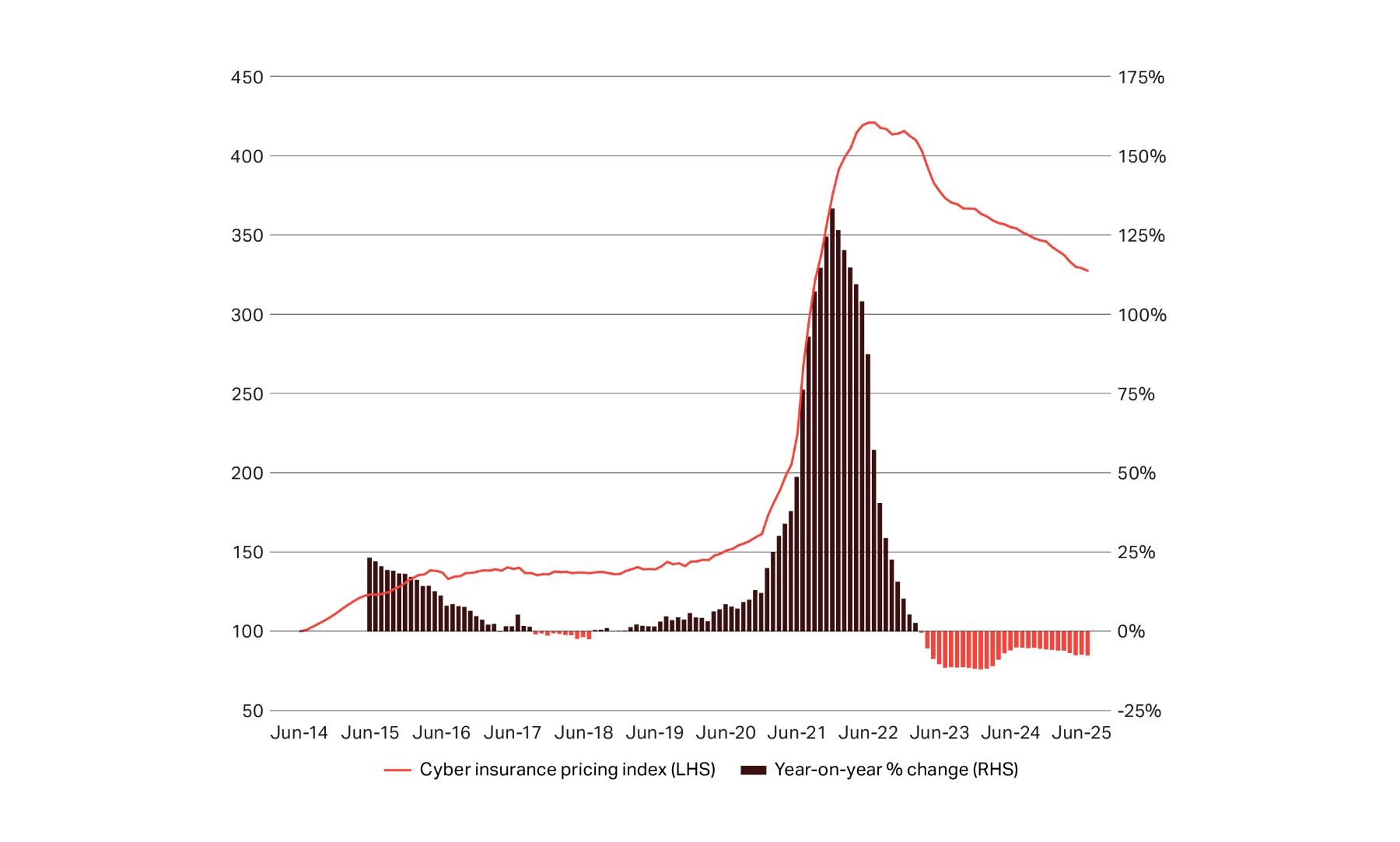

The cyber insurance market is experiencing rapid growth, with premiums projected to increase from over $15 billion to potentially more than $55 billion in the near future. As demand for faster policy issuance and more effective risk management grows, BreachBits’ technology aims to meet these needs by providing automated solutions that address key challenges faced by insurers today.

The products are powered by BreachRisk AI, a robust backend technology that has conducted over 50,000 hacker assessments since its launch in 2020.

This technology helps insurers identify, verify, and assess over 95% of potential attacker pathways as outlined in the Verizon 2024 Data Breach Investigations Report (DBIR). The result is a hacker’s-eye view of cyber risk that can proactively prevent breaches before they occur.

During their time in the Lloyd’s Lab accelerator, BreachBits successfully piloted its products with leading carriers and brokers.

The results demonstrated that the Cyber Questionnaire Validator could significantly reduce underwriting time and improve risk selection. Meanwhile, the Cyber Pre-Claim Intervention product showed promise in helping insurers actively manage cyber risks, potentially lowering the frequency and severity of claims.

By supporting BreachBits, Lloyd’s aims to enhance customer service, provide added value to policyholders, and support the market’s growth as demand for cyber insurance continues to surge.

Rosie Denée, Head of Innovation, Commercial Education and Engagement at Lloyd’s, commented: “BreachBits is revolutionising cyber risk assessment by providing insurers with key visibility into their clients’ security posture.

“Their time in the Lloyd’s Lab helped refine their approach from concept to market-ready solution, demonstrating exceptional results during pilot testing. We’re proud to support their continued growth through this investment – strengthening data-driven cyber solutions that enable our market to underwrite with greater confidence and precision.”

J. Foster Davis, co-founder of BreachBits, said: “We’re honoured by Lloyd’s investment and proud to help facilitate Lloyd’s mission of sharing risk to create a braver world. Our team is committed to addressing real-world challenges in cyber insurance and risk management – especially in complex situations and where false-positives cannot be tolerated.”

The post Lloyd’s backs BreachBits with strategic investment to strengthen cyber risk management appeared first on ReinsuranceNe.ws.