This analysis illustrates how provisions included in the House budget reconciliation bill could expose Marketplace enrollees with unpredictable incomes to higher penalties when filing taxes if they underestimate their incomes. About one in four potential Marketplace shoppers had incomes that varied at least 20 percent from the beginning to the end of the year.

Marketplace Enrollees with Unpredictable Incomes Could Face Bigger Penalties Under House Reconciliation Bill Provision

Related Post

Make American Health Care Affordable Again

In this JAMA Health Forum column, Larry Levitt highlights how the Make America Healthy Again agenda aimed at chronic disease ...

Policy Landscape of Private Insurance Coverage of Contraception in the U.S.

This issue brief explains the rules for private insurance coverage of contraceptives at the federal and state level, the exemptions ...

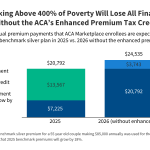

Premium Payments if Enhanced Premium Tax Credits Expire

This data note examines how the expiration of the ACA’s enhanced premium tax credits could affect the out-of-pocket portion of ...

Poll: Public Views “Big Beautiful Bill” Unfavorably by Nearly a 2-1 Margin; Democrats, Independents and Non-MAGA Republicans Oppose It, While MAGA Supporters Favor It

Medicaid Work Requirements Are Generally Popular, But Arguments Can Shift Views Nearly two-thirds (64%) of the public holds unfavorable views ...

We’ve Never Seen Health Care Cuts This Big

In this July 1 column for The New York Times Opinion section, KFF Executive Vice President for Health Policy Larry ...

Challenges with Effective Price Transparency Analyses

Promoting price transparency in health care is a policy approach with bi-partisan support in Congress and the public at large. ...

Distribution of People Ages 0-64 with Employer Coverage by Federal Poverty Level (FPL)

...

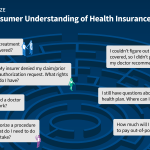

Navigating the Maze: A Look at Health Insurance Complexities and Consumer Protections

This brief discusses how consumers understand what their insurance covers, what to do when coverage for care is denied, and ...

Annual Family Premiums for Employer Coverage Rise 7% to Average $25,572 in 2024, Benchmark Survey Finds, After Also Rising 7% Last Year

Family premiums for employer-sponsored health insurance rose 7% this year to reach an average of $25,572 annually, KFF’s 2024 benchmark ...