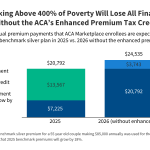

This data note examines how the expiration of the ACA’s enhanced premium tax credits could affect the out-of-pocket portion of premiums for different households.

Premium Payments if Enhanced Premium Tax Credits Expire

Related Post

Policy Changes Bring Renewed Focus on High-Deductible Health Plans

Policy changes, anticipated increases in premium costs for enrollees, and new standards for health savings accounts may encourage consumers to ...

Employer Health Benefits Annual Survey Archives

KFF has conducted this annual survey since 1999. ...

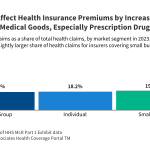

Tariffs Are Driving up Premiums for Small Businesses

Some insurers in the ACA’s small group market are citing tariffs, particularly those affecting prescriptions drugs, as a reason for ...

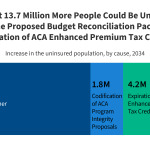

How Will the 2025 Budget Reconciliation Affect the ACA, Medicaid, and the Uninsured Rate?

This analysis details the number of people who would become uninsured from policy changes in the ACA Marketplace and Medicaid. ...

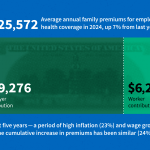

2024 Employer Health Benefits Survey

This annual survey of employers provides a detailed look at trends in employer-sponsored health coverage, including premiums, worker contributions, cost-sharing ...

Health Provisions in the 2025 Federal Budget Reconciliation Law

On July 4, President Trump signed the budget reconciliation bill, previously known as the “One Big Beautiful Bill Act,” into ...

Distribution of People Ages 0-64 with Employer Coverage by Federal Poverty Level (FPL)

...

More Than 3 in 4 ACA Marketplace Enrollees Live in States Won by President Trump in 2024

As Democrats push for an extension of the ACA’s enhanced premium tax credits, new data from KFF show the extent ...