As Marketplace Open Enrollment nears, policy changes could leave millions of people facing substantially higher premiums and coverage loss, which could lead more consumers to purchase less expensive and less comprehensive coverage through short-term health plans. KFF analyzes short-term health policies sold by nine large insurers in 36 states, examining premiums, cost sharing, covered benefits, and coverage limitations and comparing them to ACA Marketplace plans.

Examining Short-Term Limited-Duration Health Plans on the Eve of ACA Marketplace Open Enrollment

Related Post

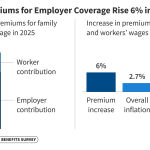

Annual Family Premiums for Employer Coverage Rise 6% in 2025, Nearing $27,000, with Workers Paying $6,850 Toward Premiums Out of Their Paychecks

Family premiums for employer-sponsored health insurance reached an average of $26,993 this year, KFF’s annual benchmark health benefits survey of large ...

Expansions to Health Savings Accounts in House Budget Reconciliation: Unpacking the Provisions and Costs to Taxpayers

The House budget reconciliation bill contains various expansions to Health Savings Accounts (HSAs). This policy watch explains what HSAs are, ...

Average Annual Single Premium per Enrolled Employee For Employer-Based Health Insurance

...

Challenges with Effective Price Transparency Analyses

Promoting price transparency in health care is a policy approach with bi-partisan support in Congress and the public at large. ...

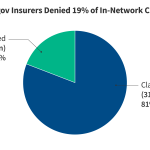

Claims Denials and Appeals in ACA Marketplace Plans in 2023

This brief analyzes federal transparency data released by the Centers for Medicare and Medicaid Services (CMS) on claims denials and ...

2024 Employer Health Benefits Survey

This annual survey of employers provides a detailed look at trends in employer-sponsored health coverage, including premiums, worker contributions, cost-sharing ...

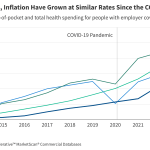

How Much do People with Employer Plans Spend Out-of-Pocket on Cost-Sharing?

This Peterson-KFF Health System Tracker chart collection examines trends in employee spending on deductibles, copayments, and coinsurance from 2012 to ...

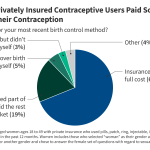

Policy Landscape of Private Insurance Coverage of Contraception in the U.S.

This issue brief explains the rules for private insurance coverage of contraceptives at the federal and state level, the exemptions ...

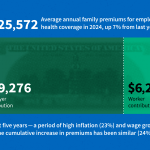

Annual Family Premiums for Employer Coverage Rise 7% to Average $25,572 in 2024, Benchmark Survey Finds, After Also Rising 7% Last Year

Family premiums for employer-sponsored health insurance rose 7% this year to reach an average of $25,572 annually, KFF’s 2024 benchmark ...

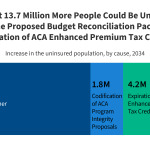

How Will the 2025 Budget Reconciliation Affect the ACA, Medicaid, and the Uninsured Rate?

This analysis details the number of people who would become uninsured from policy changes in the ACA Marketplace and Medicaid. ...